The global financial crisis in 2008 and the slump that followed were predicted to change the face of international banking, mark a retreat from globalism and result in much tighter regulation of institutions.

The last is undoubtedly true, particularly in the European Union, as this region still struggles to deal with an overhang of bad debt and ailing banks. Overall, however, the reality is that international financial activity, fuelled by technological advances, trade movements and the flows of capital produced by “quantitative easing” policies of central banks, has continued apace as the US economy has recovered and Asian banks have taken more international positions.

Will this change in the foreseeable future? What are the key drivers and, in particular, how will the UK's decision to leave the EU – Brexit – affect the sector both in the UK, the rest of Europe and elsewhere?

As the EU’s avalanche of banking regulation continues a pace and the US talks about dismantling parts of Dodd-Frank, we question whether the overall impact will strengthen the EU’s financial centres or result in more banking activity elsewhere.

The UK outlook

Brexit is already having a strong impact on banks and financial institutions which have made London their European headquarters for dealing with customers and in markets throughout the EU, taking advantage of their EU “passport” to trade throughout the EU.

In the event that the UK leaves the EU single market without a deal to continue passporting arrangements (whether on a transitional basis or permanently), banks relying on their UK bases to trade in the rest of the EU will lose their passports and even banks which have businesses regulated elsewhere in the EU will find they cannot continue to carry out certain lines of business from the UK.

Given that the UK started its two-year notice period to leave the EU at the end of March 2017 and that EU regulators will struggle to deal with the expected number of simultaneous requests for authorisation, banks are beginning to announce their intentions: for example, Bank of America plans to obtain authorisation in Ireland, HSBC expects to move some of its business to its existing substantial French subsidiary and Deutsche Bank may repatriate to Frankfurt significant parts of the business it now does in London. Several US banks, while maintaining European headquarters in London, are planning to move some activities to other centres in Europe, for example, JP Morgan is reported as intending to move jobs to Dublin, Frankfurt and Luxembourg.

Altogether it is estimated that some 9,000 jobs may move out of the UK, although London is expected to continue as a major international financial centre and continue as the EMEA regional headquarters for many international banks.

"What will actually happen to some extent depends on what the UK and the EU may agree is the nature of any transitional period and subsequent long-term relationship.”

The approach of the City is “plan for the worst and hope for the best”.

The EU outlook

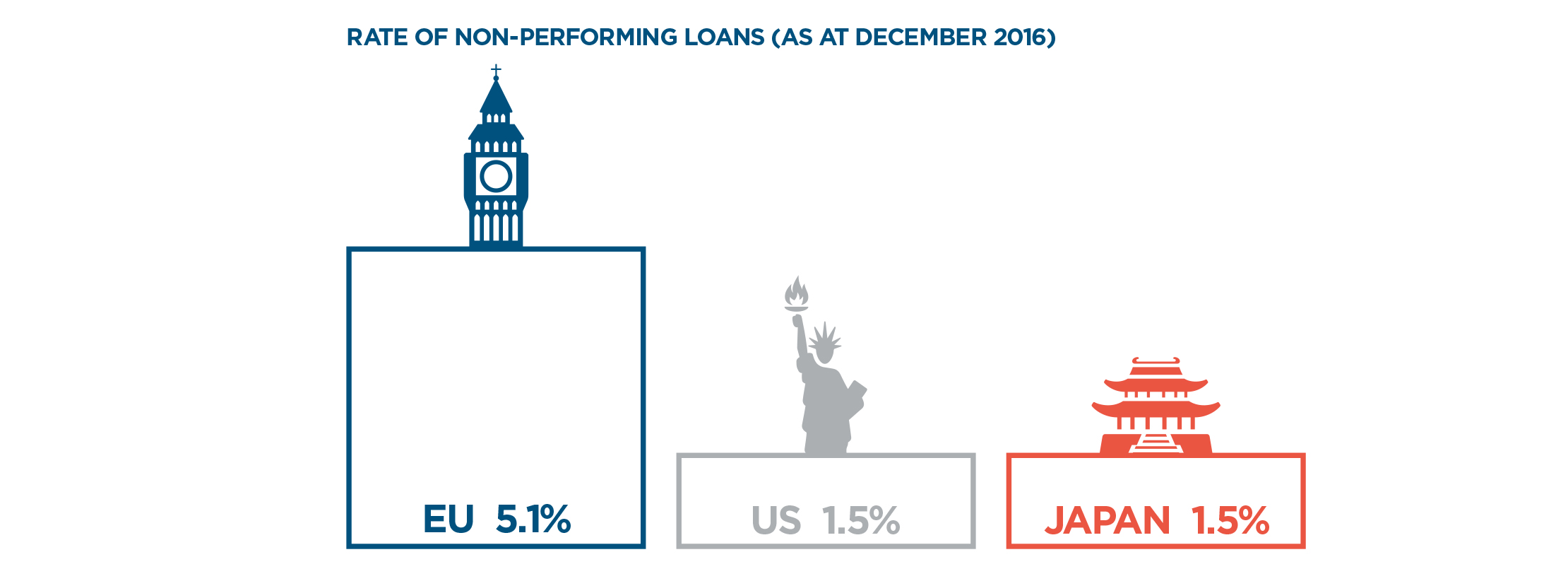

Although now showing signs of economic growth, the EU banking industry continues to be in a position of comparative financial weakness: as at December 2016, the EU on average had a rate of non-performing loans of 5.1% compared with about 1.5% for the US and Japan.

Its weakest group of countries on this measure includes one of the Eurozone's major economies, Italy: this led to the bailout in December 2016 of the significant and venerable bank, Monte Dei Paschi di Siena (founded in 1472 and the world's oldest surviving bank), followed in June 2017 by the takeover of two failing regional banks serving Venice and the surrounding area by leading lender, Intesa Sanpaolo, with support from the Italian State.

This experience, plus the difficulties for the Eurozone of operating the euro as a common currency without fiscal union, leads to a detailed and prescriptive regulatory regime for banks in the EU, with elements of protectionism against third country institutions (which can only benefit from the EU passporting regime by establishing subsidiaries which are regulated within the EU). Brexit, however, means that the EU loses its largest and only truly global financial centre.

In June 2017, the European Commission proposed new rules for enhanced supervision of any clearing house dealing with systemically-important volumes of euro-denominated trade and, in certain circumstances, a right to ensure that this activity takes place within the Eurozone. The London Clearing House, which is part of the London Stock Exchange, estimates that it clears €927 billion in euro-denominated contracts per day, some three-quarters of the global market, other parts of which are situated in the US and Far East as well as within the Eurozone. All of these may face enhanced supervision.

While this legislation potentially carries more risk for the London market than does the passporting issue, the Eurozone needs to remain outward looking to facilitate international trade and to ensure that its businesses have access to international finance denominated in euros. “The purpose of our legislative proposal is to ensure financial stability and not moving business for the sake of moving business”, according to Valdis Dombrovskis, the European Commissioner responsible for financial services.

“The voices in the EU that called for compulsory repatriation seem not to be in the ascendency at present.”

If the Commission’s announced approach is retained, it will both increase the prospects for continued business outside the EU and enhance the ability of EU businesses to access the capital they need denominated in euros, rather than US dollars or the renminbi.

Opportunities for other financial centres

Brexit has been an occasion for international banks to look at their global operations. It is thought that major financial centres in the US and the Far East may see certain activities currently or exclusively performed in London repatriated by their banks, if they can be done equally effectively back in the home jurisdiction. The recovering US economy, the prospect of lightening the burdens of Dodd-Frank currently under discussion in Washington, and the growth in increasingly-sophisticated markets in the Far East may offer opportunities for banks that are worth investing in.

This article currently appears in the Global Bank Review 2017 publication.

To download a PDF of this article click Download above.

Key contacts

Legal Notice

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2023