Stay in the know

We’ll send you the latest insights and briefings tailored to your needs

In October 2023, there were ten Rule 2.7 announcements made across the UK public M&A market and four further possible offers announced.

Notification obligations under EU Foreign Subsidies Regulation in force

The obligation to notify M&A and similar transactions under the EU Foreign Subsidies Regulation (FSR) applies from 12 October 2023.

The FSR aims to level the playing field between EU entities and competitors from non-EU Member States that are not subject to the same kind of strict rules against state subsidies as EU entities are under the EU State Aid rules. Consequently, the FSR impacts non-EU entities, including UK entities. The obligation to notify is not solely triggered where an entity involved in a transaction has received state subsidies.

Although the aim of the FSR is to address foreign subsidies that distort competition, the notification obligations are triggered where undertakings have received foreign “financial contributions”, a much wider concept. A foreign financial contribution could, for example, include payment by a non-EU government or public authority for goods and services, even where those payments were made on arm’s length market terms (so there is no subsidy).

M&A transactions and joint ventures will have to be notified to the European Commission, and clearance obtained prior to completion, if:

Failure to notify when required could result in significant fines being imposed on companies by the European Commission, as well as a risk that the transaction could subsequently be investigated and ultimately unwound if the Commission concludes that it distorts the EU internal market.

Read more about the new EU foreign subsidies regime on our competition team’s blog here.

Changes to the Takeover Code and revised Practice Statement on invoking conditions

The Takeover Panel has published a response statement (RS 2023/1) setting out changes to the rule on frustrating action in the Takeover Code. It has also published a revised Practice Statement No. 5 on invoking conditions to an offer.

Response Statement 2023/1

The Response Statement, which followed PCP 2023/1 published in May this year, mainly focuses on Rule 21 on frustrating action, but also contains some other miscellaneous changes including to the rules on the sharing of information under Rules 21.3 and 21.4.

The amendments will take effect on Monday, 11 December 2023 and will apply to all companies and transactions, including on-going transactions, from that date. The key changes are:

Updated Practice Statement No. 5

The Takeover Panel has updated its Practice Statement No. 5 on invoking conditions to an offer to reflect the Panel Executive’s approach in practice. It has also published an explanation of the changes it has made to the Practice Statement.

Under Rule 13.5(a), a bidder may only invoke a condition to an offer with the Panel’s consent, and consent will normally only be given if the circumstances which give rise to the right to invoke the condition are of material significance to the offeror in the context of the offer.

The Practice Statement discusses the factors the Panel will take into account in considering whether the material significance requirement has been satisfied. The changes to the Practice Statement do not signify a change in the Panel’s approach, but discuss in more detail what the Panel will look at in practice. It also discusses the Panel’s approach to conditions relating to there being no “Phase 2” reference by the Competition and Markets Authority or other equivalent regulators.

October 2023 Insights:

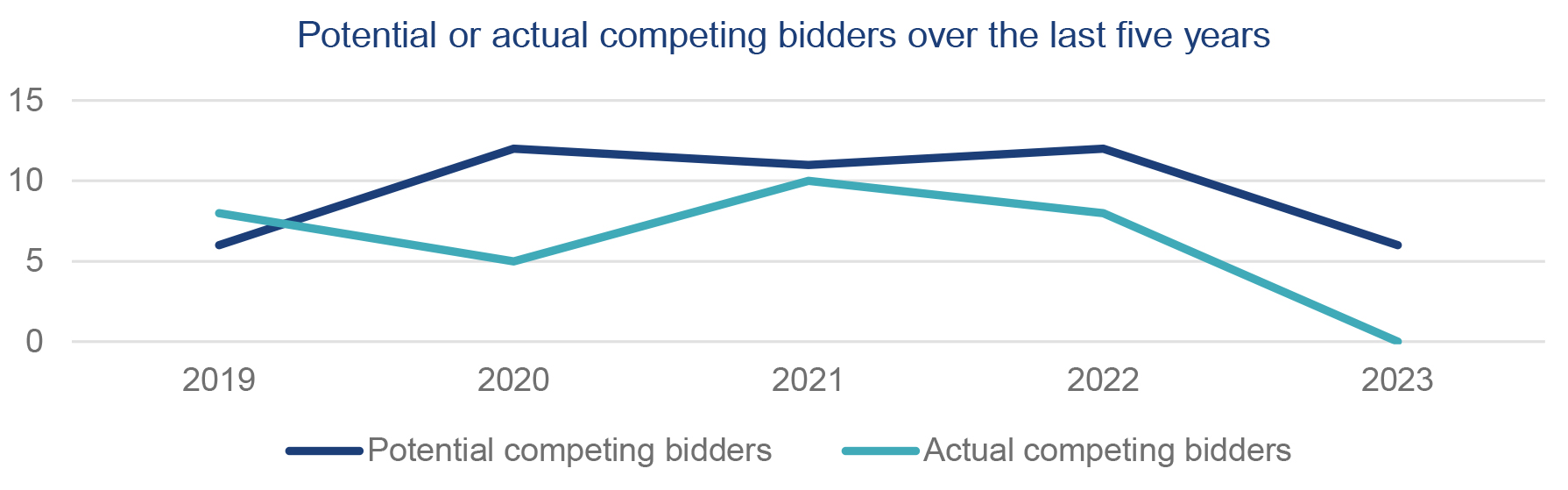

The number of firm offers made this October marks the highest number made in the last five years, with 10 firm offers announced. A further four possible offers were announced, which is more consistent with the volume of possible offers seen in previous years. This level of deal activity, combined with the volume of firm and possible offers seen in September, shows that the appetite for public M&A deals is on the rise again a year after its decline. In part, this may be driven by the perception that many UK companies are currently undervalued.

October has seen a lot of interest in The Restaurant Group plc (TRG) resulting in potential competing bidders – Apollo Global Management, Inc. made a firm offer for TRG on 12 October and Wheel Topco Limited made a possible offer for TRG on 26 October (although that has since been withdrawn due to market conditions). Apollo has now received irrevocable undertakings from activist shareholders that they will vote in favour of the scheme. Given current valuations, we may see more competitive situations. Another recent competitive situation was seen on the possible offers for Pendragon PLC – however in that case, neither of the possible offers proceeded and instead the company pursued a private disposal and strategic partnership. As public M&A deal activity starts to pick up, it will be interesting to see if the number of competitive situations increases.

The contents of this publication are for reference purposes only and may not be current as at the date of accessing this publication. They do not constitute legal advice and should not be relied upon as such. Specific legal advice about your specific circumstances should always be sought separately before taking any action based on this publication.

© Herbert Smith Freehills 2023

We’ll send you the latest insights and briefings tailored to your needs